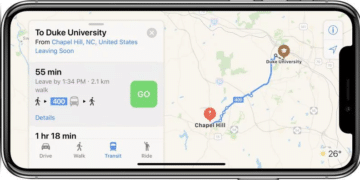

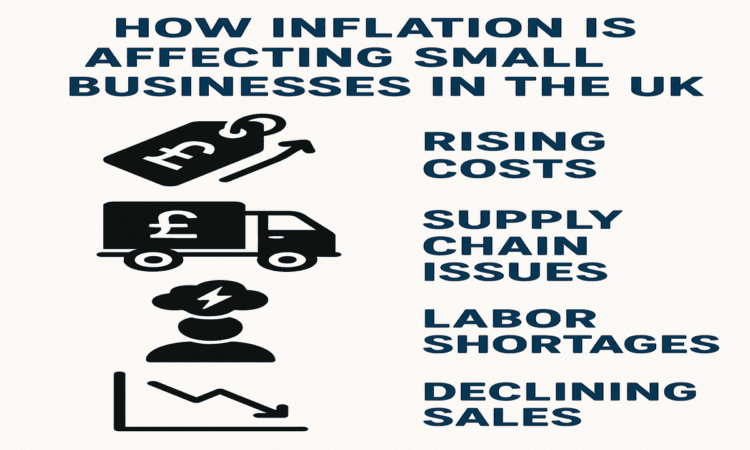

Inflation. Just one word, but it’s been causing a whole lot of headaches across the UK. Especially for small businesses. While big companies may have the luxury to ride out the storm, local shops, startups, and family-run ventures don’t always have that kind of buffer.

Let’s take a closer look at how inflation is affecting small businesses in the UK. And what they’re doing to stay afloat.

Prices Go Up, Margins Shrink

Prices of everything from raw materials to energy bills have gone up. And when costs rise, small businesses feel the pinch the hardest. Unlike large corporations, many small enterprises can’t simply hike up their prices without losing customers.

Imagine running a local bakery. The price of flour has gone up, electricity bills are through the roof, and even packaging costs more than it did last year. But if you raise your prices too much, your regulars might start going elsewhere. It’s a tightrope walk.

Supply Chain Woes and Delays

Inflation sends ripples across everything. Supply chains, for instance, have become a lot less predictable. Costs are rising, yes, but delays are also more common now. That’s a double whammy.

Let’s say you run a small clothing boutique and your supplier’s prices have jumped by 15%. Not only are you paying more, but your shipment is also arriving two weeks late. That means lost sales, frustrated customers, and a big dent in your cash flow.

Customers Are Spending Less

While business owners are trying to deal with rising costs, customers are also tightening their belts. That’s what inflation does. It eats away at everyone’s purchasing power.

People are now thinking twice before buying that extra coffee, booking a weekend getaway, or splurging on non-essentials. For small businesses that rely on regular footfall or impulse buys, this is a serious challenge.

Struggles with Staffing

Hiring is another area where small businesses are feeling the heat. Wages have gone up in many sectors, and there’s pressure to offer competitive pay just to attract (and keep) good staff. But again, it’s not that easy.

A small café in Manchester, for example, may want to give its team a well-deserved raise. But if their profit margins are already razor-thin thanks to inflation, where does that money come from?

Many owners are now juggling roles themselves. Working longer hours, covering shifts, and cutting back on staff. Burnout is real, and it’s becoming more common among entrepreneurs.

Financing and Loans Just Got Pricier

Getting a loan used to be one way for small businesses to keep their operations running smoothly. But with interest rates rising in response to inflation, borrowing has become more expensive.

Some business owners are now second-guessing whether they should take on that extra line of credit or invest in a new piece of equipment. There’s more risk involved, and for many, it’s just not worth it anymore.

So, What Lies Ahead?

Despite these hurdles, UK small business owners have shown incredible resilience. They’ve navigated a global pandemic, ongoing Brexit-related uncertainty, and now persistent inflation. Through grit, adaptability, and support from local communities, many are finding ways to survive—and even thrive—in these uncertain times.

Operating a small business in today’s climate is no easy feat. It requires determination, resourcefulness, and an unshakable belief in what they do. But as every entrepreneur knows, nothing worth doing ever comes easy.

If you’re reading this and have a favorite local shop, café, or service provider, now is a great time to show your support. Whether it’s buying a coffee, writing a positive review, or simply sharing their story with friends and family, even the smallest act can make a significant difference.

As the UK continues to adapt to the lasting impact of Brexit on its businesses, community support has never been more vital. Let’s stand with the small business owners who keep our neighborhoods vibrant and our economy strong.